Unlock Financial Opportunities With a Home Equity Funding

Consider the possibilities that exist within utilizing a home equity funding. As we discover the technicians and advantages of home equity finances, you might uncover a course to unlocking covert financial potential that could reshape your economic landscape.

Advantages of Home Equity Fundings

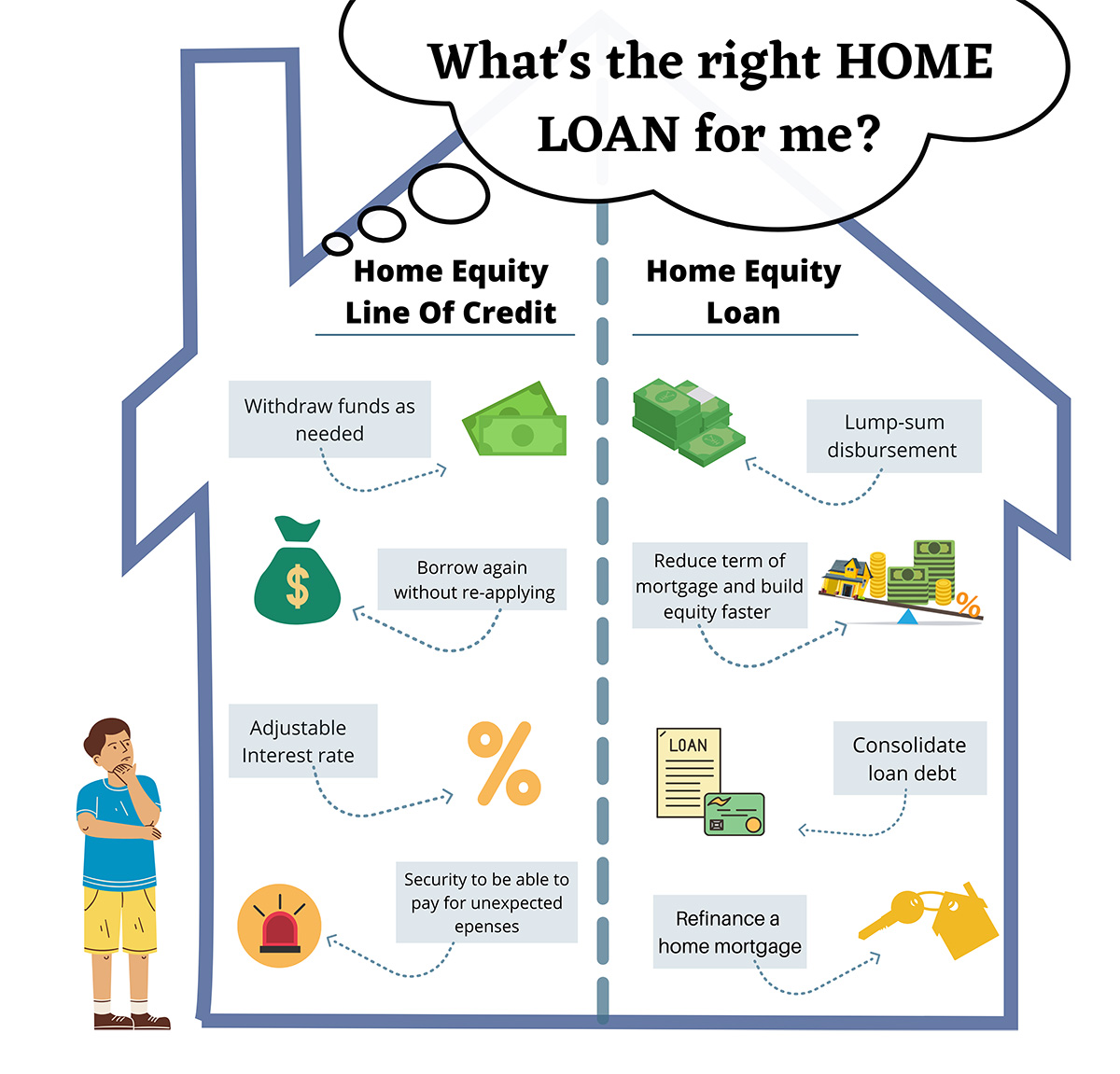

Home Equity Car loans use home owners a versatile and sensible monetary service for leveraging the equity in their homes. Among the main advantages of a Home Equity Finance is the ability to access a large amount of cash upfront, which can be made use of for different purposes such as home renovations, financial obligation combination, or financing significant costs like education and learning or medical costs. Equity Loans. Furthermore, Home Equity Car loans frequently feature lower rate of interest contrasted to various other sorts of loans, making them a cost-efficient borrowing alternative for home owners

One more benefit of Home Equity Loans is the potential tax obligation benefits they provide. In several situations, the interest paid on a Home Equity Car loan is tax-deductible, giving house owners with an opportunity to conserve money on their taxes. Home Equity Fundings generally have longer payment terms than other types of finances, permitting consumers to spread out their payments over time and make handling their funds extra convenient. In general, the advantages of Home Equity Car loans make them a useful device for home owners seeking to unlock the monetary possibility of their homes.

How Home Equity Loans Work

Given the substantial advantages and benefits outlined pertaining to leveraging the equity in one's home, recognizing the mechanics of how equity financings run ends up being crucial for house owners looking for to make enlightened financial choices. Home equity loans are a sort of loan in which the borrower uses the equity in their home as collateral. Equity is the difference between the assessed worth of the home and the outstanding mortgage equilibrium.

When a house owner applies for a home equity financing, the lending institution reviews the worth of the residential or commercial property and the amount of equity the customer has. Alpine Credits Equity Loans. Based on this analysis, the lending institution determines the optimum funding amount that can be prolonged. Home equity finances usually have actually repaired rate of interest rates and are paid out in one round figure. Borrowers after that pay back the car loan over an established term, making normal month-to-month settlements. The interest paid on a home equity finance might be tax-deductible, making it an attractive option for home owners seeking to fund significant expenses or combine high-interest financial obligation. Recognizing the terms, payment framework, and potential tax obligation benefits of home equity lendings is necessary for property owners considering this monetary alternative.

Using Home Equity for Restorations

Making use of the equity in one's residential or commercial property for improvements can be a strategic monetary step that not just improves the space yet likewise includes worth to the home. Home equity car loans supply homeowners the chance to accessibility funds based on the value of their property beyond the exceptional home mortgage equilibrium. When taking into consideration renovations, leveraging home equity can supply an affordable service compared to various other forms of borrowing, as these car loans commonly use lower passion prices due to the security given by the property.

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

Combining Financial Debt With Home Equity

When taking into consideration monetary strategies, leveraging home equity to settle debt can be a sensible alternative for people looking for to improve their settlement responsibilities. Combining financial obligation with home equity includes taking out a car loan utilizing the equity developed in your house as collateral. This approach allows debtors to combine numerous financial obligations, such as bank card balances or individual lendings, right into one single payment. By doing so, people may take advantage of lower rate of interest provided on home equity car loans contrasted to other forms of financial obligation, possibly reducing overall rate of interest costs.

Additionally, settling financial obligation with home equity can streamline the settlement process by combining various website link settlements right into one, making it easier to stay clear of and manage financial resources missed repayments. It likewise has the possible to enhance credit history by lowering the general debt-to-income ratio and demonstrating accountable debt administration. It is vital to very carefully take into consideration the dangers entailed, as failure to pay back a home equity lending might lead to the loss of your home via repossession. Consulting with an economic expert can assist figure out if settling debt with home equity is the best choice for your financial situation.

Tips for Securing a Home Equity Funding

Securing a home equity loan calls for precise preparation and a comprehensive understanding of the lending institution's requirements and assessment requirements. Prior to using for a home equity financing, it is important to evaluate your monetary circumstance, including your credit scores score, existing financial obligation commitments, and the amount of equity you have in your home - Alpine Credits.

Look for competitive rate of interest prices, favorable loan terms, and low charges. By demonstrating economic responsibility and a clear understanding of the loan terms, you can boost your opportunities of safeguarding a home equity finance that lines up with your demands and goals.

Conclusion

In verdict, home equity loans use a variety of advantages, including the capacity to accessibility funds for restorations, financial obligation loan consolidation, and other monetary needs. By leveraging the equity in your home, you can unlock brand-new opportunities for handling your finances and achieving your goals. Equity Loans. Comprehending just how home equity lendings work and adhering to best practices for securing one can aid you take advantage of this important economic device

Home equity lendings are a type of car loan in which the debtor utilizes the equity in their home as collateral (Alpine Credits Equity Loans). Consolidating financial debt with home equity includes taking out a car loan utilizing the equity constructed up in your home as security. Before applying for a home equity financing, it is essential to assess your financial scenario, including your debt rating, existing financial debt responsibilities, and the quantity of equity you have in your home

Comments on “Exactly How Home Equity Loan Can Money Your Next Big Task”